Custody tax oversight

We analyze your custodian's withholding tax recovery service to ensure it's working effectively and help you make the most of what your custodian offers.

Increase net portfolio returns by streamlining custody oversight and optimizing global withholding tax reclaims

Optimize withholding tax recovery | Improve operational efficiency | Reduce compliance risk

We analyze your custodian's withholding tax recovery service to ensure it's working effectively and help you make the most of what your custodian offers.

We reclaim withholding tax opportunities that fall outside the scope of your custodian's offering, like "ECJ reclaims" or reclaim markets not serviced.

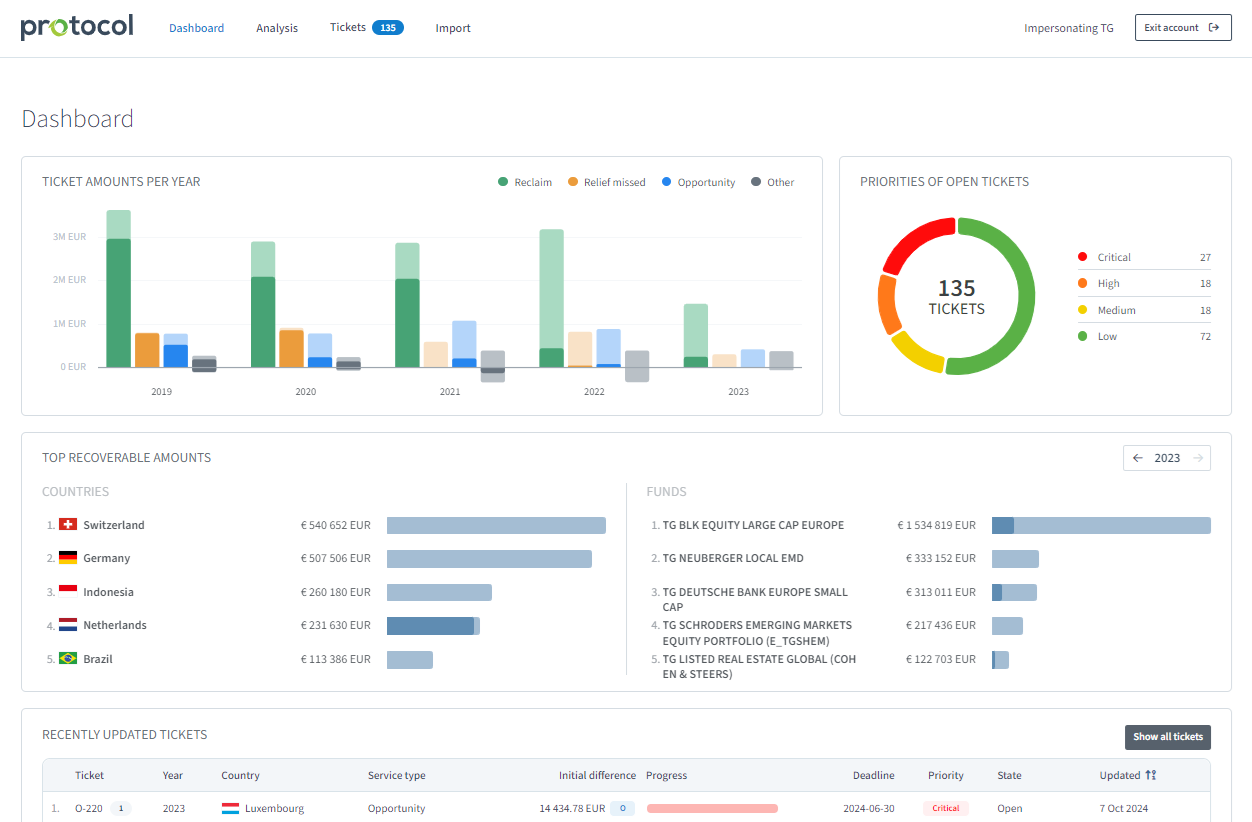

Our technology platform Protocol is for institutional investors and asset managers who need a structured, highly efficient and proactive approach to custody tax oversight and global withholding tax recovery.

Protocol captures custody tax services gaps and non-custody tax reclaims as they arise, preventing delays or forfeiture. Automated task prioritization and notification helps meet dealines and boosts withholding tax recovery.

Leverage Protocol's process automation and ongoing income and custody tax data validation and analysis to recover more with fewer resources.

Maintain full oversight over your custodian’s recovery service and your non-custody withholding tax reclaims in an intuitive dashboard that organizes and tracks all required actions.

Stay updated on global withholding tax changes, rates, treaties, reclaim opportunities, and case law.

JANUARY 15, 2026 • 5 minute read

This country-by-country guide provides a comprehensive overview of dividend withholding tax reclaims worldwide, helping institutional and professional investors identify reclaim opportunities, understand local requirements, and assess operational complexity in 2026.

JANUARY 8, 2026 • 4 minute read

Brazil has enacted Law 15,270/2025, reintroducing withholding tax on dividend distributions for the first time in nearly three decades. Effective 1 January 2026, the new regime has important implications for foreign institutional investors, including pension funds and sovereign entities.

DECEMBER 22, 2025 • 5 minute read

A Spanish TEAC ruling shows how U.S. group trusts must prove beneficiary-level residence to obtain Spain–U.S. treaty withholding tax relief.

Find out how we can help you optimize your withholding tax recovery.